Private Debt Asset Management

Attraktive Renditen

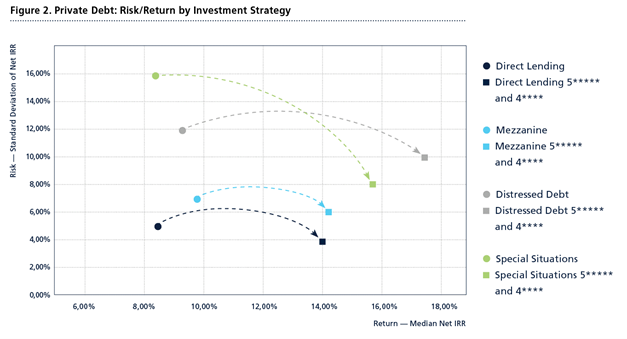

Abhängig von der Anlagestrategie und der Fund-Selektion ergeben sich im Private Debt unterschiedliche und attraktive Renditen von durchschnittlich rund 10%.

Die wachsende und heute rund USD 800 Milliarden umfassende Anlageklasse reift jedoch, und die Breite und das Volumen potenzieller Investment-Opportunitäten nimmt laufend zu, was die Anforderungen an eine professionelle Fund-Selektion erhöht. Professionellen und institutionellen Investoren machen wir attraktive Private Debt – Fund – Investments im Beratungsmandat zugänglich. Einen Überblick über das Risiko- und Return – Profil von Private Debt – Funds finden Sie nachstehend.

Risk and return by investment strategy. Circles show the cross-sectional return, proxied by the median net IRR, and risk, proxied by the standard deviation of net IRRs. Squares show the same values for funds of the 5***** and 4**** return category as defined by Remaco The data are from Preqin, October 2020

Remaco Asset Management AG profitiert vom umfassenden und unabhängigen Research der Remaco Advisory Services AG, und erhält von Zeit zu Zeit attraktive Anlagevorschläge im

Private Debt. Sie können Ihre Investitionen mit Konto- und Depotführung bei unserem

Wertpapierhaus, der Remaco Asset Management AG, oder ggf. bei einer Drittbank

abwickeln.

Gerne informieren wir Sie in einem persönlichen Gespräch über die Chancen und Risiken von Private Debt – Investments und zeigen Ihnen dabei auf, wie wir in dieser neuen und attraktiven Assetklasse zu Gunsten unserer Kunden agieren.

Disclaimer

The present Document has been published by Remaco Asset Management AG (“Remaco”). It is handed out personally to specific and selected recipients by Remaco and may not be distributed to third parties without prior consent of Remaco. Moreover, in any case, it may not be used by natural or legal persons, who are citizens or residents of a state, country or territory in which the current laws prohibit the distribution, publication, issue and use of such a research document. The user itself is responsible to prove, that the acquisition of the information within this Document is legal. This material is for informational purposes only and should not be considered as an offer or a request to buy or sell a financial instrument or as a contractual document. Nothing contained in this Document constitutes an issuance prospectus pursuant to articles 652a or 1156 of the Swiss Code of Obligations or a similar law or regulation. The performance data and related calculations contained in this Document are only estimated and can be changed without announcement. The information presented is considered reliable though Remaco Asset Management AG does not guarantee their accuracy and completeness. Past performance is not a guide for future performance. Remaco Asset Management AG excludes, without restriction, any liability for losses and/or damages of any kind- including any direct, indirect or consequential damages – that arise from the use of the present Document.

News

Pascal Böni hält Keynote Speech am Private Markets Forum 2024 der Finanz & Wirtschaft

Am Private Markets Forum der Finanz & Wirtschaft haben sich auch im März 2024 Experten und...

The Credit Suisse bailout in hindsight: not a bitter pill to swallow, but a case to follow.

Es ist nun ein Jahr her, dass die Credit Suisse im Rahmen einer staatlich orchestrierten Notfusion...

Remaco-Report | 2024 Q1

Kapitalmarkterwartungen in Schweizerfranken In der Studie «Kapitalmarkterwartungen in...