Private Debt Asset Management

Attractive Returns

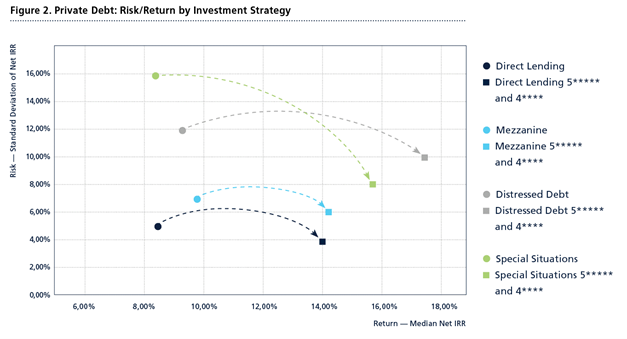

Risk and return by investment strategy. Circles show the cross-sectional return, proxied by the median net IRR, and risk, proxied by the standard deviation of net IRRs. Squares show the same values for funds of the 5***** and 4**** return category as defined by Remaco The data are from Preqin, October 2020

Disclaimer

The present Document has been published by Remaco Asset Management AG (“Remaco”). It is handed out personally to specific and selected recipients by Remaco and may not be distributed to third parties without prior consent of Remaco. Moreover, in any case, it may not be used by natural or legal persons, who are citizens or residents of a state, country or territory in which the current laws prohibit the distribution, publication, issue and use of such a research document. The user itself is responsible to prove, that the acquisition of the information within this Document is legal. This material is for informational purposes only and should not be considered as an offer or a request to buy or sell a financial instrument or as a contractual document. Nothing contained in this Document constitutes an issuance prospectus pursuant to articles 652a or 1156 of the Swiss Code of Obligations or a similar law or regulation. The performance data and related calculations contained in this Document are only estimated and can be changed without announcement. The information presented is considered reliable though Remaco Asset Management AG does not guarantee their accuracy and completeness. Past performance is not a guide for future performance. Remaco Asset Management AG excludes, without restriction, any liability for losses and/or damages of any kind- including any direct, indirect or consequential damages – that arise from the use of the present Document.

Your Contact

lic.oec.publ.

CEO Remaco Asset Management AG

News

Remaco-Report | 2024 Q2

Kapitalmarkterwartungen in Schweizerfranken In der Studie «Kapitalmarkterwartungen in...

Pascal Böni hält Keynote Speech am Private Markets Forum 2024 der Finanz & Wirtschaft

Am Private Markets Forum der Finanz & Wirtschaft haben sich auch im März 2024 Experten und...

Remaco-Report | 2024 Q1

Kapitalmarkterwartungen in Schweizerfranken In der Studie «Kapitalmarkterwartungen in...