Remaco World Portfolio

The idea of the Remaco World Portfolio

The wisdom of experts for an optimal mix of equities, bonds and alternative investments. In any market phase.

The challenge: It is often the case that investors rely on the individual opinion of their bank or asset manager – who are sometimes right and sometimes wrong.

Our solution: The Remaco World Portfolio uses the expert intelligence of over 25 global institutional financial market experts to optimise the weighting of asset classes. This minimises the risk of individual opinions.

What makes the Remaco World Portfolio unique

Utilising the wisdom of the experts

Every quarter, we analyse the forward-looking capital market assumptions of over 25 global institutional financial market experts, use their collective wisdom and derive the relative attractiveness of Equities, Bonds and (Liquid) Alternatives Investments.

Disciplined and rule-based implementation

We implement the allocation in a disciplined and rule-based manner that rests upon a transparent and

scientific model. We avoid making poor discretionary decisions and refrain from investment myths

(e. g., stock-picking, market timing, home bias). The strategy makes use of cost-effective passive instruments.

Broad diversification

The Remaco World Portfolio is always diversified and has an attractive risk / return profile. It is suitable both

as a complete solution or as part of an individual investment strategy.

Geographic Allocation Remaco World Portfolio

Source: Remaco-Report 2025 Q2 as of March 31, 2025. / Illustration: Own representation / Remaco Research.

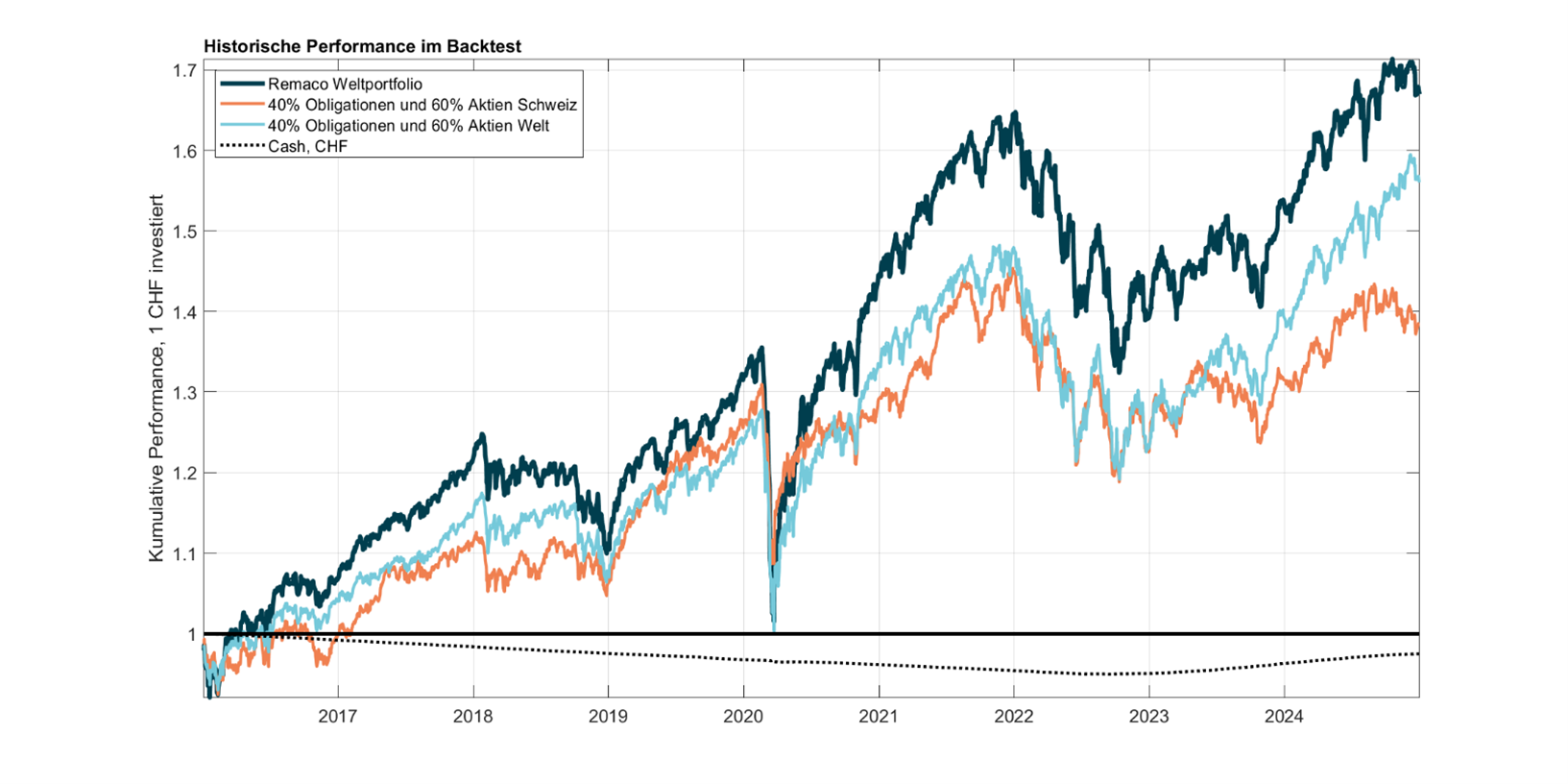

The Remaco World Portfolio compared to static portfolios

Cumulative performance of an investment of one Swiss franc invested on 1.1.2016 through 31.12.2024.

Past performance is not necessarily a guide to future performance.

Source: Remaco-Report Survey of Capital Market Assumptions in Swiss Francs, 2025 | Q1.

How to invest in the Remaco World Portfolio

With Remaco or a partner bank

You open a custody account with us and invest in our world portfolio or you have a custody account with our partner bank managed by Remaco

At your house bank

You purchase the investment certificate from Luzerner Kantonalbank (LUKB).

The Remaco World Portfolio is research-based

When developing the Remaco World Portfolio, we took into account the results of financial market research. We summarise how numerous investors make misguided decisions and lose long-term performance. We explain how these investment myths can be avoided.

Examples of how we avoid investment myths and poor discretionary decisions

Home Bias

Situation Asset managers and investors in Switzerland weight domestic companies significantly higher in their portfolios than foreign ones.

Fact The overweighting of Swiss equities costs performance. Over a period of 10 years, the underperformance compared to the global market adds up to over 20 per cent.

Solution Our global portfolio is globally diversified and does not permanently overweight Swiss equities.

Market Timing

Situation Many asset managers try to identify the best time to buy or sell securities during short-term market movements in order to achieve a higher return.

Fact Predicting market movements accurately and making the right decisions at the right time is almost impossible. Many studies show that it is difficult to consistently outperform through market timing.

Solution Our global portfolio pursues a long-term, rule-based investment strategy and thus avoids emotional decisions.

Stock Picking

Situation

Many asset managers hope to generate an excess return through the targeted selection of individual shares, investment themes and certain investment strategies.

Fact

Higher risk: Individual stocks and investment themes are often more volatile than the broad stock market. This increases the risk of losses if the portfolio is not sufficiently diversified. Many studies also show that it is difficult even for professional investors to outperform the market over the long term in this way.

Solution

Our global portfolio offers a cost-effective way of investing in attractive asset classes. It is implemented with exchange-traded funds (ETFs). This reduces the portfolio risk.